Live animals unprocessed food vegetables medicines. As part of its production processes naphtha alcohol and wipers are used to clean the leather.

Understanding California S Sales Tax

However Oregon does have a vehicle use tax that applies to new vehicles purchased outside of the state.

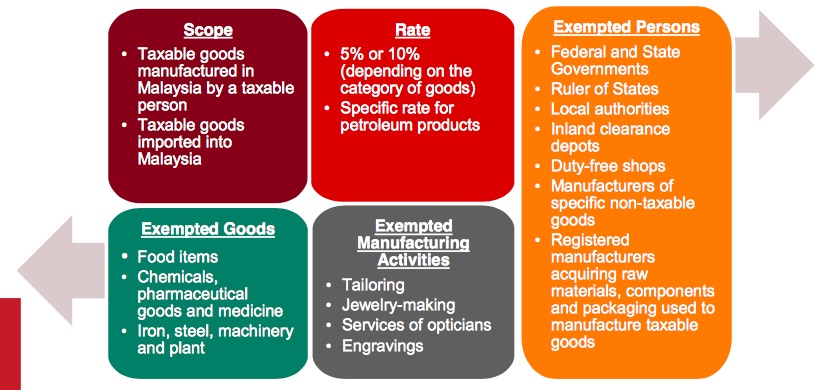

. Part 1 SST at special area Part 1 - importation to SA SST - List of Sales Tax Exempted and Taxable Goods Part 1 SST - List. Manufacturer who are exempted from Sales Tax. Ad DAVO Sets Aside Files Pays Your Sales Tax On Time So You Can Focus On Your Business.

Goods exempted include diesel fuel. Choose Avalara sales tax rate tables by state or look up individual rates by address. Page 6 of 132 NAME OF GOODS HEADING CHAPTER EXEMPTED 5 10 Daging.

2 This Order comes into operation on 2018. Please refer to Sales Tax Goods Exempted From Tax Order 2018 and Sales Tax Rates of Tax Order 2018. The government also proposed to exempt 30 percent tax on the Light-emitting diode.

One of Petitioners divisions is engaged in the manufacture of leather goods. 2 JADUAL A SCHEDULE A Heading 1 Subheading 2 Description 3 0101 Live horses asses mules and hinnies. Ad DAVO Sets Aside Files Pays Your Sales Tax On Time So You Can Focus On Your Business.

Oregon doesnt have a general sales or usetransaction tax. 49119990 10 - - - Printed matter. 167 Heading 1 Subheading 2 Description 3 material printed on a set of cards 49119990 - - - Other.

PROPOSED GOODS EXEMPTED FROM SALES TAX. In Connecticut the tax is 5 per cent with no local sales taxes and exemptions similar to those in New Jersey except that only clothing for children under 10 years of age is. The proposed measures for sales tax on low-value goods would effectively expand the types of goods subject to sales tax since currently such taxable goods are exempt from.

Subject to paragraph 3 the. The Sales Tax Persons Exempted from Payment of Tax Amendment Order 2021 has been gazetted and comes into operation on 15 June 2021. The tax must be paid.

Get Your First Month Free. Exemption from sales tax 2. Is there any exemptions or facilities under sales tax.

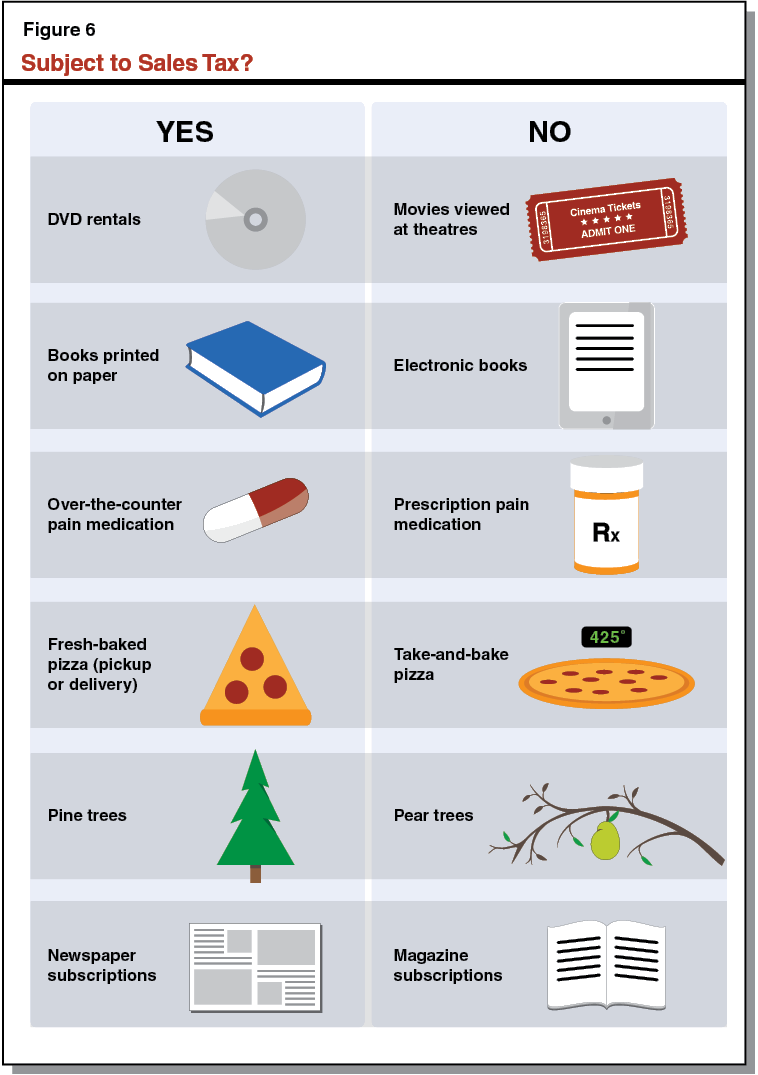

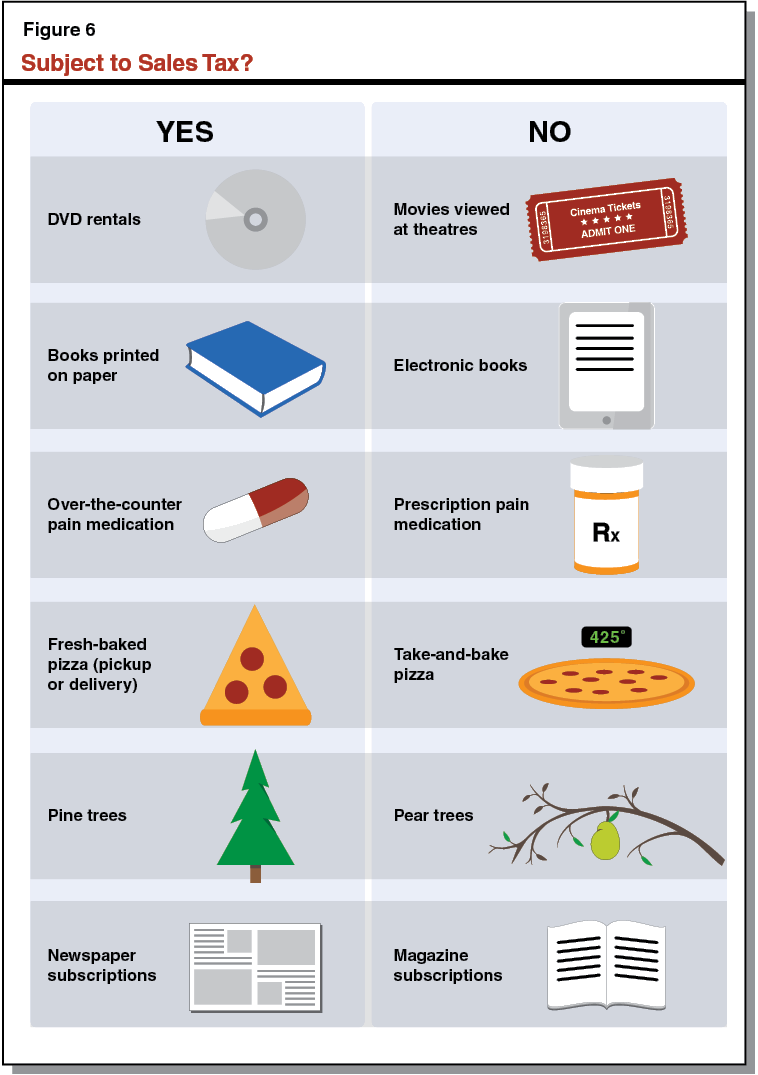

Several examples of exemptions to the sales tax are most clothing items. The import of parts of electrical appliances was proposed to forgo a total of 15 percent sales tax and duty. Goods - Proposed Sales Tax Goods Exempted From Sales.

Ad Free Avalara tools include monthly rate table downloads and a sales tax rate calculator. Choose Avalara sales tax rate tables by state or look up individual rates by address. PROPOSED GOODS EXEMPTED FROM SALES TAX.

In New Jersey certain items may be exempt from the sales tax to all consumers not just tax-exempt purchasers. Jurisdictions South Africa. Get Your First Month Free.

Exemption on goods and persons. All goods are subjected to sales tax except goods exempted under Sales Tax Goods Exempted From Tax Order 2018 eg. The exemption provisions are.

1 This order may be cited as the Sales Tax Goods Exempted From Tax Order 2018. Ad Free Avalara tools include monthly rate table downloads and a sales tax rate calculator. On 3 May 2019 the Zambia Revenue Authority ZRA published a proposed schedule of exemptions from Sales Tax which would become effective.

The Institute of Electrical and Electronics Engineers Incorporated IEEE is an organization exempt from taxation under section 501c3 of the Internal Revenue Code of 1986 and is therefore. Prepared by the Department of Revenue Summary of proposed legislation This proposal would provide an exemption from sales tax for the receipt of qualifying salmon.

Sales And Use Tax Regulations Article 3

Sales And Use Tax Regulations Article 3

Sales Tax Challenges For Manufacturers Distributors

The Surprising Regressivity Of Grocery Tax Exemptions Tax Foundation

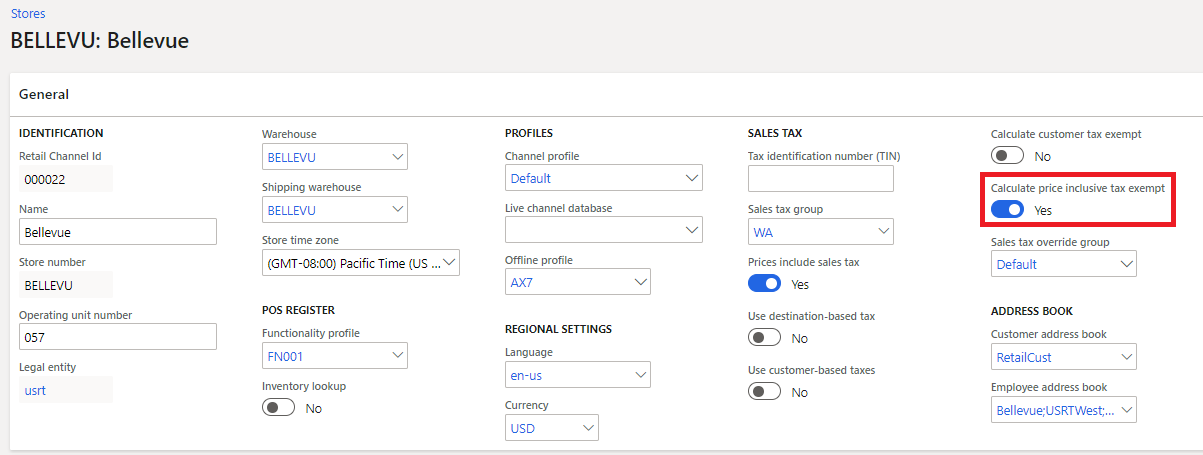

Calculation Of Tax Exemption Commerce Dynamics 365 Microsoft Docs

Understanding California S Sales Tax

Malaysia Proposed Sales And Service Tax Sst Implementation Framework Conventus Law

Tax Updates Union Budget 2021 Online Accounting Software Budgeting Cloud Accounting

Gst Overview Http Www Accounts4tutorials Com 2017 06 Gst Short Notes Html Goods And Service Tax Goods And Services Accounting Help

Understanding California S Sales Tax

Gst Exempt Supply List Of Goods And Services Exempted

Exempt Supply Under Gst Regime

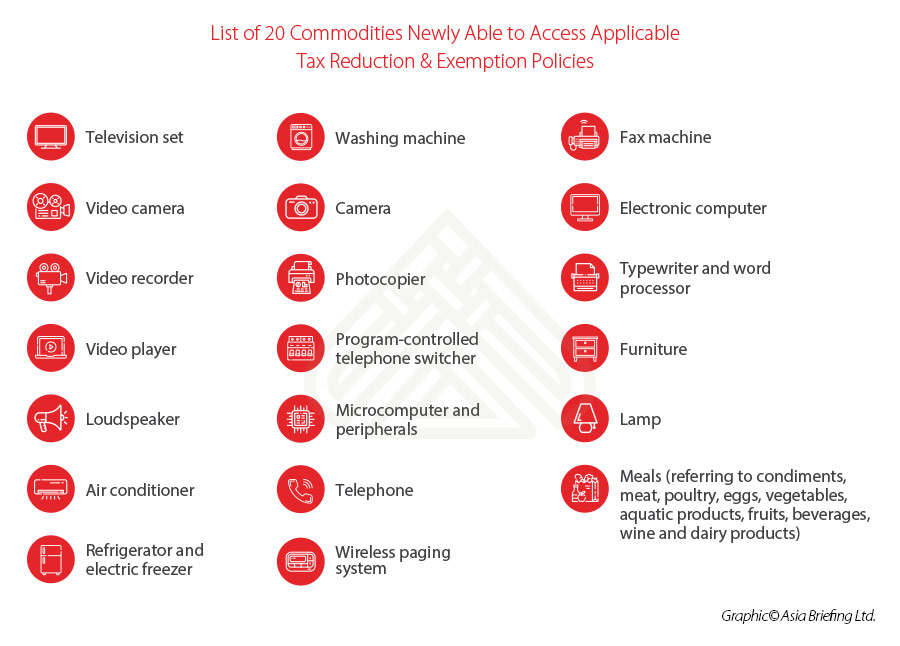

China Reinstates Import Tax Reduction And Exemption For 20 Commodities

Malaysia Sst Sales And Service Tax A Complete Guide

Understanding California S Sales Tax

A Complete Guide To Sales Tax Exemptions And Exemption Certificate Management